All areas of the sports industry have been affected by the coronavirus pandemic and this includes the investment in sporting businesses. While there may be disruption in the short term, several leading investors believe that the industry will continue to provide excellent opportunities over the long term.

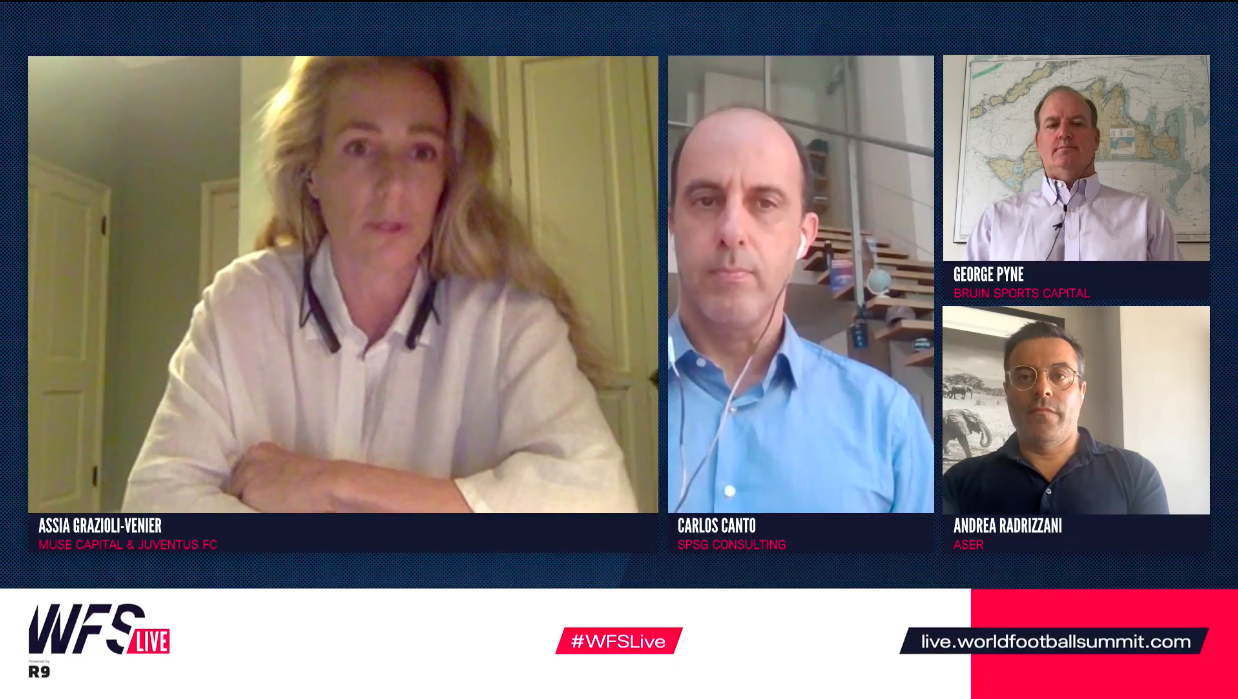

This was the view of the three panellists who took part in the ‘Aftermath Of Investments In Sports’ discussion during WFS Live, Powered by Ronaldo. Taking part in that virtual round table were George Pyne, CEO and founder of Bruin Capital, Assia Grazioli-Venier, founding partner of Muse Capital and a Juventus board member, and Andrea Radrizzani, chairman and founder of Aser Ventures.

They concurred that the passion and emotion inherent in sports means that the industry will be in good health once the Covid-19 pandemic is over. “Over the long run, sports is going to be a great investment” Pyne stated. “Long term, there’s nothing like sports. Sports represent who you are and what you stand for and your values. So, there’s nothing like it. Sports brings people together during difficult times for positive outcomes. So, that’s an incredible outcome in a world that is going to be more fragmented from a media standpoint. Sports is one of the few things that you can invest behind that gets you big and passionate audiences.”

“Long term, there’s nothing like sports. Sports represent who you are and what you stand for and your values. So, there’s nothing like it.” – George Pyne, CEO & Founder – Bruin Capital

That said, Pyne did admit that the short-term outlook is less certain. He went on: “In the long term I think sports is a great play. In the short term it’ll be a little choppy, but in the short term it provides real opportunity. So, I think you’re going to see more and more people look to invest in the sports business for those reasons.”

Grazioli-Venier agreed that there is a lot to be positive about when looking a decade into the future. “I am long-term investor. I look seven to 10 years ahead. I’ve always done that since I was a child. I’m the opposite of living in the moment. For me, I look seven to 10 years ahead and I see teams becoming true lifestyle brands, not just communicating and engaging with the fans on the pitch, but working with them across the board in the other areas of their lives. That’s why I think you have to look at investment opportunities outside of the core sports space.”

Radrizzani, meanwhile, joked about how he’d never had so many people return his calls as he has experienced in recent months, expressing his optimism that there will be good opportunities in the sports industry for a long time to come.

This panel took place during the second day of WFS Live, which is running from Monday July 6th to Friday July 10th. It is still possible to buy a ticket here, with all net proceeds to be donated to Fundação Fenômenos and the Common Goal Covid-19 Response Fund.

Quotes from the ‘Aftermath Of Investments In Sports’:

- George Pyne on what he looks for in an investment opportunity:

“You’re asking is the strategy good or is the jockey. We believe that you can have the best ideas, but without the right management you can’t go anywhere. To me, you’ve got to have the right management team and the strategy. You’d like to get both. But, if I had to pick between one and two then I’d rather back the people because, even if the people are going down the wrong road, eventually they’re going to find the right road. So, of the two, I believe in people over strategy, but I’d like to find good strategy and good people.”

- Assia Grazioli-Venier, on the current capital flow:

“There is capital flowing around. It surprised me as well to be honest, because we all operated on the worst-case assumptions during the first three months of Covid and that’s how we prepare for the future. I think all of us on this panel are used to doing that. But, I was very very surprised at how much capital is flowing. It’s more important now than ever that, because it’s not as much capital, that the capital is value-add and that you really choose your partners wisely.”

- Assia Grazioli-Venier on teams and franchises further embracing non-gameday revenue streams:

“I think teams have to start thinking again and not just on the pitch. They need to realise that they truly are a lifestyle brand. Ten years ago, or longer than that, if you said that teams were selling merchandise and selling mugs and pins then you would have said that was crazy. Now, it’s full speed ahead. It’s a strong source of revenue. So, there are still a lot of new opportunities that we can explore.”

- Andrea Radrizzani, on the appetite for investment he has come across in the past few months:

“I’ve been trying to put together finance in football leagues for the last eight years and I was always very close, but with no luck to conclude any deal. But, the last four months, I think I’ve never seen [so many people] call me back from New York or London. We’re working on different opportunities. Overall, I think it’s a great chance for leagues to involve different management and more professional management and inject capital that can close a short period of need, but at the same time regenerate and invigorate and completely restructure the business case.”